Learn how to grow

your ecommerce business.

Creator Marketing in a Zero‑Click World: Make Owned Channels Your Advantage

Our favorite posts.

Browse posts

by category.

Creator Marketing in a Zero‑Click World: Make Owned Channels Your Advantage

Generative engine optimization (GEO) and tightening privacy rules are rewriting the rules of attention. Fewer clicks land on your site, and a growing share of those visitors show up as anonymous. The

What Marketers Need to Know About the New Texas SB 140 Law

Texas is known for doing things big, and that now includes its telemarketing regulations. A new state law, Senate Bill 140 (SB 140), is set to take effect on September 1, 2025, and it's a

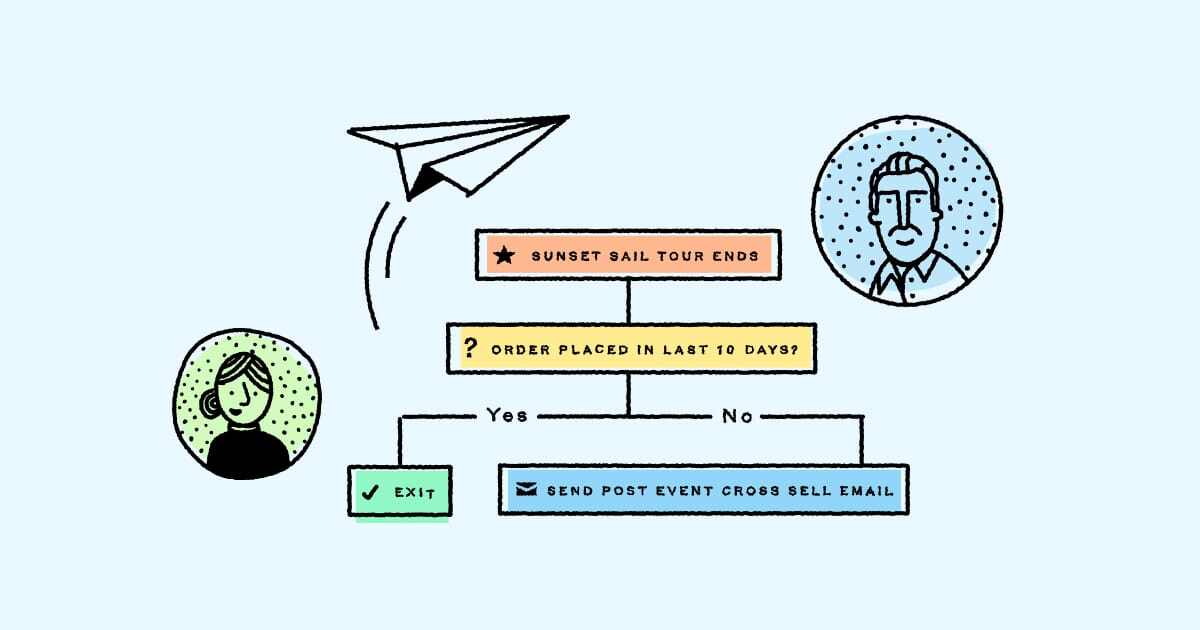

Tourism Marketing: Build Stronger Customer Relationships Through Email

The global travel experience market could soon be worth a cool $1 trillion – music to the ears of providers who slogged through the long, hard months of the pandemic. But if you’re going to grab your

Apple iOS 18.2: What It Means for Your 2025 Email Marketing Strategy And Beyond

Apple released iOS 18.2 on December 12th, 2024, and with it came major changes to the Apple Mail inbox. While there are no major privacy impacts this time (we can all breathe a sigh of relief), there

4 Actionable Black Friday Cyber Monday Insights for Your 2024 Strategy

For marketers, July is the new September. As Black Friday has become Black October, if it feels like we’re kicking off our Black Friday Cyber Monday (BFCM) planning earlier and earlier each year,

9 Must-Have Email Examples for the Fashion & Apparel Industry

The fashion and apparel industry is exploding right now. According to a new report by Shopify, “Experts predict that the ecommerce segment of fashion and apparel will increase at a compound annual

How to Get Email Tone Right [and Adapt it to Your Unique Customer Journey]

Anyone who’s ever had an argument will be all too familiar with the phrase: “It’s not what you said, it’s how you said it.” Those words of wisdom are just as relevant to ecommerce marketing as they

4 Proven Strategies for Transforming Casual Shoppers into Repeat Purchasers

Converting an ecommerce lead into a first-time buyer is a big deal. Suddenly, they’re no longer just another name on your marketing list: they’re a paying customer. Which means they’re well on the

7 Advanced Welcome Emails from Top Ecommerce Brands

Of all the email campaigns you ever build, your welcome series is the most important. Welcome emails see an average open rate of 63.91 percent—almost three times higher than all types of promotional

Come for the automated marketing. Stay for the endless revenue growth.

Start a 14-day free trial, no credit card required.

![How to Get Email Tone Right [and Adapt it to Your Unique Customer Journey] Cover Image](https://www.drip.com/hubfs/tone_in_email-BLOG.png)